qplum is a digital way for people to get the services offered by a hedge fund, for a reasonable price. If you’re like me and have no clue what that means, the wonderful people at qplum make it simple and affordable.

What do hedge funds offer? They give people access to certain investment strategies and the best means of trade execution. They usually cost too much because the people who run hedge funds are greedy! It’s like in all those movies!

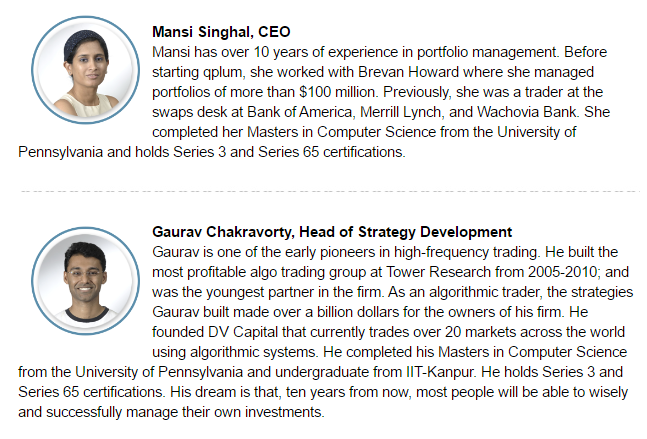

I was recently invited to the qplum headquarters located in Jersey City which is run by a wonderful local couple Mansi and Gaurav to hear more about this awesome service.

Now how were Mansi and Gaurav able to offer hedge fund services for a lower price? They combined Gaurav’s data science expertise and Mansi’s portfolio management experience to create an online platform where users go through a series of simple questions that determine their risk tolerance and their goals (buy house, pay for school, start a business, etc.). Then, they are matched with an appropriate strategy. There are strategies for people who are young and brazen. There are strategies for older folks who need to make an income from their investments.

What are your names? Hi! I’m Gaurav. I’m Mansi.

So what do you guys do primarily? What is this company?

Mansi: qplum is an online wealth management service. Gaurav and I were very fortunate in our professional careers, and that’s how we were able to start this. My area is traditional portfolio management, Gaurav’s expertise is in high-frequency trading. We were really good at increasing profitability for banks and hedge funds. In late 2014, we saw an opportunity to bring this service to our friends and family, and here we are.

How long has this company been around?

Mansi: We started in early 2015, and launched our product in February of this year.

So it’s only online?

Most of the interaction happens online. In this day and age, everybody wants that kind of experience. But, investing is very personal, so our engagement with users is offline as well. That’s why we have meetups and webinars.

So you guys are both the founders?

Gaurav: Co-founders.

How do you guys know each other?

Gaurav: We’re married. We’ve known each other since 2004!

I knew it! How is it working together?

Gaurav: She’s my boss twenty-four hours a day.

Is that how you guys met in the same industry?

Mansi: We met at the University of Pennsylvania. We were both in the computer science program; and we both really like finance. Yes, we’re total nerds.

So you guys are trying to get recognition in Jersey City.

Mansi: Jersey City is very special for us. We immigrated here in 2004 so J.C. is where we started our second life. It’s where we earned our first paycheck, bought our first car and house. We’re raising our daughter here. We’ve grown a lot in this community.

Can you break down what QPlum does for people?

Gaurav: Imagine if I showed you a million pictures of a face. By the time I am done, you’d know that a face has two ears. Then I show you a picture of a face with only one ear. You’d know something was wrong, that something was missing. This is what we do with markets—we use computers to take millions of pictures of the market, then use that info to make smart investment decisions. That’s the essence of it.

Mansi: When you talk about data science, things can get real complicated real fast. In a nutshell, we help people invest their money so they can have a secure financial future. Let me give you the virtual experience. You go on our website. We ask you some questions to get a feel for your financial needs. Then, we design an investment strategy to help you meet your needs. Our strategies can be passive or active. You can tweak your portfolio at any point. An easy way to think about qplum is that it’s your personal, affordable, liquid, transparent hedge fund.

What about people who don’t know anything about it? I don’t know anything about management, my husband sits with me once a month and goes over what we have. What about people like me who don’t have a spouse but is interested in saving for the future?

Mansi: qplum is designed as a teaching tool. We explain every step of the process in simple, straightforward language. No jargon allowed. We encourage you to ask about anything you don’t understand. And we’ve got our online and offline meetups so you can learn more about different finance issues. We’re having one this week!

What is it about?

Gaurav: It’s about investing, how investing is about skill and discipline, not luck.

Mansi: It’s about how investing is something you can do every day in a totally normal way. Like checking your mail. As Carl likes to say— “Investing is very ordinary. It’s not what you see in the movies.”

Gaurav: The thing you said about some people knowing more than others—like your husband knowing about the finances—there are lots of things I’ve learned that your husband would love to know.

Why work with qplum?

1) qplum does not just dump your money into a ‘basket of products’ (it’s an industry term, meaning collection of assets). This is the approach taken by most money managers. This type of approach doesn’t account for your risk tolerance, tax needs, life goals/fears.

2) qplum invests in strategies (personalized investment solutions) not products.

3) qplum teaches people how to invest. Clients are kept informed every step of the way. The process is completely transparent. It’s designed so you develop an intutive understanding of how’s and what’s of investing.

4) qplum charges a flat-fee. This is a huge deal since hedge funds usually have hidden fees or charge large commissions. Plus, qplum uses the best means of trade execution. This means their clients don’t lose money through outdated, slow trading methods.

Mansi: We are so big on community engagement. People need to have a place where they can talk freely about finance issues, where they can share their experience and learn from each other. A big reason why more people don’t invest is that finance is treated like a dirty little secret. It’s crazy. But, we’re going to change that.

How many employees are you here?

Gaurav: Fifteen.

And you guys have a ping-pong table here?

Mansi: You’re welcome to try; some people are very competitive here.

Do you guys live in Jersey City?

Mansi: Yes.

Do you guys have a favorite Jersey City hangout spot?

Gaurav: We love running along the waterfront and Amelia’s.

Mansi: Come on, Amelia’s is your favorite spot. Ever since our daughter was born, we’ve run in every 10k and half marathon.

That’s great! So you’re both runners.

Yeah, together.

You guys are cool. So you are business owners, you are parents, you run, you travel the world. Is there anything else I’m missing?

Gaurav: What we need to do more of is slow down.

So what’s next for QPlum?

We’re confident about what we’ve done. We just want to take the questions as they come and keep helping people.

Mansi: We believe in reaching out to the community and talking to them. So it’s not like, this is our platform, take it or leave it. Investing can be private, but it can also be social. People talk to friends and ask, “Should I do this? Should I do that?” We want to develop that kind of trust with the community. That’s our biggest goal right now, to develop that mutual trust, that bond.

Anything else you’d like people to know about you or QPlum?

Gaurav: They can reach us anytime.

Come play ping-pong.

Mansi: Oh yeah!

Get to know Mansi and Gaurav below, and check out qplum’s YouTube channel for an in-depth look at what they do!

Visit them here!

You must be logged in to post a comment.